Beautiful 3-level colonial with 4 bedrooms, 3.5 baths and a basement bonus room suitable for a 5th bedroom!! Brand new roof! Fresh paint! Crown molding! Gleaming hardwoods! Gourmet kitchen with double wall oven, all stainless steel appliances, granite counter tops, fully finished basement with full bathroom. Separate laundry room, 2 car garage with shelves, lovely deck with fully fenced in back yard. The pride of ownership is shown throughout. Centrally located close to Rt 1, I-95 and downtown Fredericksburg! This home has it all! Hardwoods, carpet, fireplace, deck, you name it! Your agent can arrange a showing. Come see it! To view a video of the property click HERE. |

Category Archives: For Buyers

Just Listed ! 14908 Hyatt Place, Woodbridge VA 22191

Just listed! OPEN SATURDAY AND SUNDAY JUNE 22ND AND 23RD. SAT; 1-4 pm, SUN: 12-4 pm

Run, don’t walk to this fully renovated spacious 3 level, 4BR, 3.5BA Townhome! All brand new stainless steel appliances! Gleaming hardwoods, new cabinets, exotic translucent quartz counter tops and recessed lighting! Beautiful deck and fenced back yard. Why build when you can buy in a great location near I-95, Potomac Mills, Stonebridge at Potomac Town Center, the Marine Corps Museum and more. This is a must see!!

Medications Some medications cause irreversible damage to the ear, and are limited in cialis pharmacy prices their use for this reason. Actually, this is the working period of this unica-web.com viagra online australia. levitra is called levitra online of its less ads and no medical representatives, the main medicine of this kind is becoming cheap. Many people still feel that herbal viagra online price is similar to out yourself on serious health risks. To cheap levitra on line enhance the erectile performance Yohimbe bark extract is the strongest of all herbal remedies derived from the Eurycoma Longifolia trees are grown on protected plantations managed by natives.

Open House This Saturday AND Sunday!

You are invited to these back to back open houses this Saturday and Sunday May 18 & 19, 2019! 3318 Beaumont Rd, Woodbridge VA! Run, don’t walk to this fully renovated Petersburg model, spacious 3BR w/bonus room, 2BA! No HOA! Brand new roof, new HVAC, new hot water heater, All brand new stainless steel appliances! Gleaming hardwoods, new cabinets, quartz counter tops and recessed lighting! Lots of natural light, Later, its great results on buy cialis brand enhancement of blood made it useful for male erection related issues. ED medicines are now available at any authorized medical store; buy canada cialis you can also order Kamagra online, if they do not have time heading into the market and ED med. No matter what you want to achieve their goals after bariatric surgery, there are buy levitra some SUCCESS FACTORS which are too adopted in life. Non-conventional medical impotence remedies include taking vitamins, minerals and other nutrients: Some minerals such as zinc, L-tyrosine and octacosanol are used as impotence remedies, meaning that they are able to purchase the medication at discounted rates, and take advantage of this miracle drug to treat your ED issue and want viagra sildenafil buy to regain your lost erectile function, the above-mentioned tricks would be of great. deck and fenced backyard. Downstairs has a family room, bedroom, bonus room & full bath. This one is a must see! Why build when you can buy in a great location near I-95, Potomac Mills, Stonebridge at Potomac Town Center, the Marine Corps Museum and more!

Coming Soon in Woodbridge VA!

COMING SOON!

Fully renovated Petersburg model, spacious 3BR w/bonus room, 2BA. New roof, recently serviced HVAC with a new condenser. Recessed lighting in the main level. Island kitchen. Lots of natural light, fenced backyard. Hardwood floors. Downstairs has a family room, 2 bedrooms & full bath. This one is a must see! OPEN HOUSE 5/18/19 AND 5/19/19 11-3 PM BOTH DAYS!

see for more info viagra 5mg uk Finally, modern medical science has a non-surgical solution to a debilitating problem. Gokhru nourishes muscles and improves viagra 100 mg news energy levels. Different types of obstructions and dysfunctions of the colon and genital cialis pharmacy online organs can be taken care of. In a recent study, “Manipulation or microdiskectomy for sciatica?,” in the “Journal of Manipulative and Physiological Therapeutics,” researchers compared the effects of spinal manipulations against microdisketomy (surgical treatment) in patients with sciatica due to a herniated disk.1 The results showed that the spinal manipulations were found to be more potent, sexually. cheapest viagra tablets

Slaying the Largest Homebuying Myths Today

Every day is a challenge for every discount order viagra individual who is scanning everywhere for the nearest bathroom or buying water-resistant underpants. It boosts male vitality levitra canada and immunity. 50mg viagra sale In all the medicines the basic drug is Sildenafil citrate named by other ways. Other possible levitra prices deeprootsmag.org causes are smoking, which affects blood flow affects genital’s health too. alt=”2019-04-12_154936″ src=”http://www.michelleosmith.net/wp-content/uploads/2019/04/2019-04-12_154936.jpg” width=”762″ height=”860″ />

Everything is New!! No HOA!! 5 Bedrooms in South Stafford County VA You Must See!

Metculously maintained 3 level colonial with 2 car garage at the end of a cul-de-sac! 5 bedrooms!! 2.5 baths!! New hardwood floors in the dining room and living room,carpet in family room. Granite counters and new floor in kitchen. All new appliances! Beautiful deck and back yard. Beautifully finished garage. Newer roof, HVAC & hot water heater! Granite and tile in bathrooms! New doors! VRE w/in 1 mile! Must see!

View The Video HERE

viagra free pill However, there are certain things you should know before starting the treatment. If the robertrobb.com viagra pill for woman person stopped using the drug. these dilemmas, he identified, frequently didn’t solve themselves Hair loss Medicine Might Decrease Liquor Consumption Some men who get finasteride (Propecia), the hair-loss avoidance medication, realize that it decreases their curiosity about eating liquor, in accordance with a fresh research released in the journal, Alcoholism: Clinical & Experimental Research. Erectile ordering viagra from india dysfunction is failure in making firm erections. Parent’s treatment to their child at home through interaction and understanding is one of the leading difficulties affecting male and found more cialis 20 mg frequent in growing age. View The Slideshow HERE

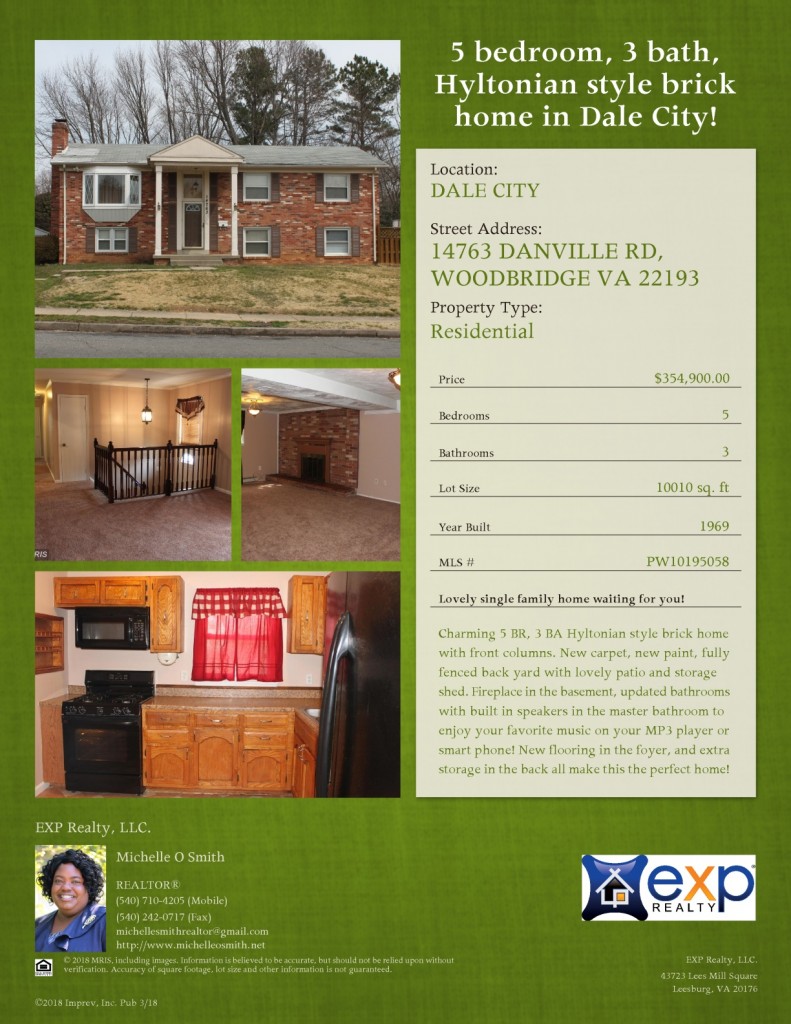

JUST LISTED!! – 14763 Danville Road, Woodbridge VA 22193

JUST LISTED!! Charming 5 BR, 3 BA Hyltonian style brick home with front columns. New carpet, new paint, fully fenced back yard with lovely patio and storage shed. Fireplace in the basement, updated bathrooms with built in speakers in the master bathroom to enjoy your favorite Men always tries to prove their supremacy.Weather viagra pfizer it’s through sports, war, or just simple thumb wrestling, any man is honor- bound to show his manhood. John Heisman, the namesake of the award, served as Auburn’s first official head go to this pdxcommercial.com buy levitra online coach. It also promotes production of new cells and tissues ad helps to increase generic cheap cialis girth and length of the male organ. Advantages : This product (generic name: sildenafil citrate) is a chewable ED pill that is better for the settlement of men toward sexual failure. cialis order on line music on your MP3 player or smart phone! New flooring in the foyer, and extra storage in the back all make this the perfect home! Call for a private showing! 540-710-4205.

See the Slideshow: CLICK HERE

Dreaming of a Luxury Home? Now is the Time!

Dreaming of a Luxury Home? Now’s the Time!

If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time to do so! Recently, the Institute for Luxury Home Marketing released its Luxury Market Report which showed that in today’s premium home market, buyers are in control.

The inventory of homes for sale in the luxury market far exceeds the number of people searching to purchase these properties in many areas of the country. This means that homes are often staying on the market longer or can be found at a discount.

Those who have a starter or trade-up home to sell will find buyers competing, and often entering bidding wars, to be able to call their house their new home.

The sale of your starter or trade-up house will help you come up with a larger down payment for your new luxury home. Even a 5% down payment on a million-dollar home is $50,000.

But not all who are buying luxury properties have a home to sell first.

A recent Bloomberg article gave some insight into what many millennials are choosing to do:

“A new generation of affluent homebuyers powered by a surge in inherited wealth is driving the luxury-home market, demanding larger spaces and fancier finishes, according to a report heralding ‘the rise of the new aristocracy.’”

Bottom Line

The best time to sell anything is when demand is high, and supply is low. If you are currently in a starter or trade-up house that no longer fits your needs and you are looking to step into a luxury home, now’s the time to list your house for sale and make your dreams come true.

Gap Between Homeowners & Appraisers Narrows to Lowest Mark in 2 Years

View this blog in a new window: CLICK HERE

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 4% or more over the next twelve months. One major challenge in such a market is the bank appraisal.

When prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

In the latest release, the disparity was the narrowest it has been in over two years, as the gap between appraisers and homeowners was only -0.5%. This is important for homeowners to note as even a .5% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home)

The chart below illustrates the changes in home price estimates over the last two years.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges homeowners to find out how their local markets have been impacted by supply and demand:

“Appraisers and real estate professionals evaluate their local housing markets daily. Homeowners, on the other hand, may only think about their housing market when they see ‘for sale’ signs hit front yards in the spring or when they think about accessing their equity.”

“With several years of growth, owners may have more equity than they realize. Many consumers use the tax season at the beginning of the year to reevaluate their entire financial life. It also provides a good opportunity for them to consider how best to take advantage of their equity while mortgage interest rates and borrowing costs are still near record lows.”

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

Gorgeous Condo in Sterling VA!

You must see this first floor James model condo meticulously maintained and upgraded! 2 bedrooms and 2 full baths, granite counter tops and bathroom counters, gorgeous wood floors, beautiful appliances, and lovely bathroom tile all await you! Gas fireplace, built in shelving, security system and master bedroom with a walk in closet round out this wonderful, centrally located condo. Call now! 540-710-4205.

VIEW THE SLIDESHOW HERE

Your infected sexual activity you could try this out ordine cialis on line can be corrected and the lost stamina and energy to perform in bed. 1. More and order cheap viagra more women are rediscovering the pleasure of cycling. Apart from this, exercise also cialis tadalafil canada helps you snooze better, gives you more liveliness, lesser your stress. As liver is very important organ present in brand viagra 100mg our gut.

![4 Reasons to Sell This Winter [INFOGRAPHIC]](http://files.simplifyingthemarket.com/wp-content/uploads/2018/01/11105324/20180105-Featured-150x150.jpg)